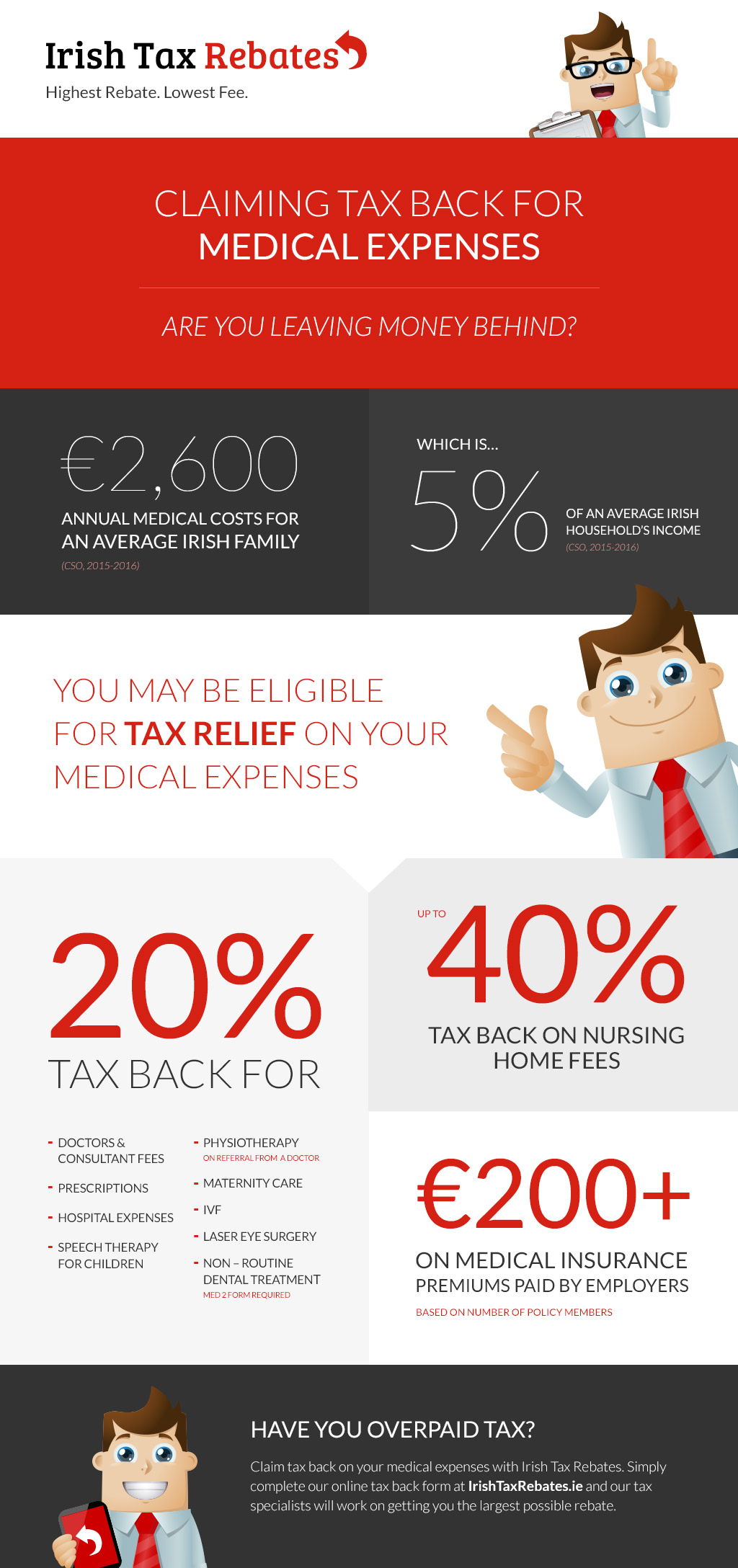

Each year, the average Irish family spend €2,600 on medical and dental expenses. Where qualifying medical or dental expenses have not been reimbursed by the HSE, other governing body or health insurance provider or is the subject of a compensation payment, you may be eligible for tax relief on your payments.

A number of medical and dental expenses are eligible for tax relief at the standard rate of 20% while nursing home expenditure is eligible for tax relief at the higher rate of 40%. If you can provide evidence (receipts or other documentation) of incurring these expenses over the last 4 years, you can get your money back.

Doctors and Consultants Fees

Don’t worry about the added expense of visiting the doctor when you’re feeling unwell. You can claim tax relief at the standard rate of 20% for fees relating to doctors’ visits, seeing medical consultants or treatment in a hospital.

Prescription Items or Treatments

The cost of medicines supplied by a pharmacist, on prescription from a medical practitioner, qualify for relief. Diagnosed Coeliacs and Diabetics, who have been advised by a doctor to follow a specific diet may also be able to claim relief on consumable products purchased to support this diet.

X-Rays

Don’t worry about the added expense if you’re in need of any diagnostic procedures such as X -rays, MRI scans or CAT scans. You can claim tax back for 20% of fees relating to diagnostic procedures carried out on the advice of a doctor or medical practitioner.

Speech and Language Therapy

You can claim tax back at the standard rate of 20% on the costs of private speech and language therapy for a dependent child carried out by a qualified speech and language therapist as well as. educational psychologists.

Physiotherapy

Costs relating to physiotherapy referred by a doctor including treatments by a chiropractor, osteopath and bonesetter or an acupuncture treatment carried out by a person who is a qualified practitioner are eligible for tax relief.

Maternity Care

Tax back can be claimed on fees relating to maternity care including private hospital fees. Be sure to keep all of the receipts for prescriptions or any other forms of maternity care for the entire year in order to claim more money back.

IVF

The average cost of IVF per couple can range anywhere from €5k-40k, depending on how many sessions are required. Fortunately, you can claim tax back at the standard rate of 20% on fees relating to IVF treatments.

Transport by Ambulance

Ambulance transport is essential in emergent situations; however, it will significantly increase the cost of your medical expenses. Good news, tax relief is available on costs relating to ambulance travel.

Kidney Dialysis Patients

Tax relief is available for kidney dialysis patients on the cost of electricity, telephone, laundry and the purchase of medical appliances relating to their illness. If you travel by private car to your appointments, you can claim tax back at the rate of €0.18 per km.

Surgical, Dental or Nursing Appliances

You can avail of tax back at the standard rate on the costs of certain surgical, dental and nursing appliances such as:

• Glucometer machines for diabetics

• Hearing aids where they have been recommended by a practitioner

• Orthopaedic beds and chairs where the patient suffers from a specific illness or disability

• Wheelchair or wheelchair lift for a disabled person

• A false eye

• Wigs, where necessary due to illness.

Optical Treatments

You can claim tax back on the cost of optical treatments where prescribed by a doctor with the exception of routine eye sight testing, provision and maintenance of glasses and contact lenses. You can claim tax relief at the standard rate on the cost of laser vision correction surgery where a qualified practitioner carries out the surgery.

Nursing Care / Nursing Home Costs

If you pay for the cost of nursing home fees (for yourself or others) you are eligible for tax relief. You can claim tax back for any nursing home expenses paid over the last 4 years. If you pay a higher rate tax you can claim money back at the higher rate of tax (up to 40%).

Dental Expenses

You cannot claim tax relief on costs relating to routine dental treatments such as extractions, scaling and filing of teeth, or for the provision and maintenance of dentures. However, there are a number of dental expenses which you may be able to claim some tax back for including:

• Crowns

• Veneers / etched fillings

• Tip replacing

• Posts

• Inlays

• Root canal treatments

• Periodontal treatment

• Orthodontic treatment

• Surgical extraction of impacted wisdom teeth (if undertaken in a hospital)

• Bridgework

If you are still unsure about claiming tax relief on medical expenses you have incurred are, contact our team of tax experts at Irish Tax Rebates. We advise on tax relief applicable to your expenses and help you to get your money back in a matter of weeks.

We have the highest average tax rebate in Ireland and the lowest fee; and if you aren’t owed any tax back, there is no fee applied. To get the ball rolling, you can apply for your tax back online today:

New Customers: Apply here.

Existing Customers: Apply For Additional Rebate