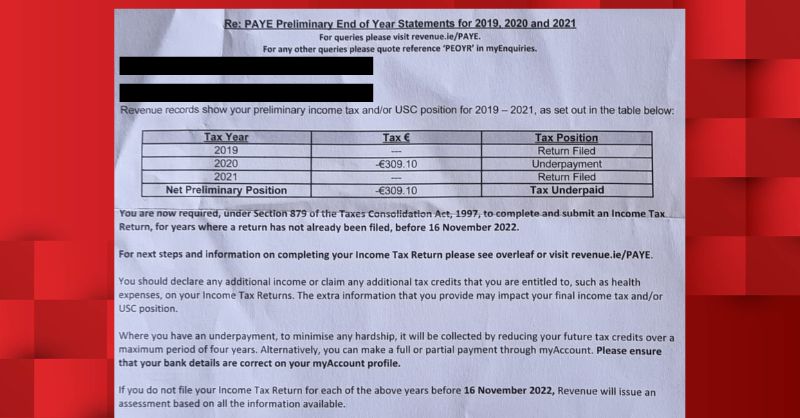

Have you received a letter from Revenue, notifying you of underpayments? Don’t worry, you’re not alone.

Over 300,000 taxpayers are set to receive these letters over the coming weeks notifying them of underpayments, but don’t panic, as your tax agent, Irish Tax Rebates are here to help. These letters have requested that PAYE workers file their Tax Return for the years that are outstanding on their Revenue profile.

Irish Tax Rebates have engaged with officials from Revenue to discuss the letters being sent out to taxpayers. We have outlined the results of this engagement and the further action required below.

Please note, as your tax agent, we work on your behalf and we are now aiming to reduce or eliminate these underpayments, once you have provided Irish Tax Rebates with permission to do so.

What is an underpayment?

An underpayment is when you have paid less tax than you were liable to pay. If you have paid too little tax, you will owe Revenue the difference between what you actually paid and what you should of paid.

Have you received an underpayment letter from Revenue?

Below are the points of information we need to inform all our clients of regarding these Revenue letters and the actions that we advise to minimise or eliminate your underpayments.

After speaking with a Revenue representative, we can now confirm that if a tax return is not filed for the years 2019-2021, Revenue may issue a result via a notice of assessment. However, Revenue will introduce the below repercussions for taxpayers until such a time that the taxpayer or their tax agent files the outstanding returns.

- Block any further rebates due to you.

- Revoke your Tax Clearance Certificate.

- Increased tax compliance programmes for the coming years.

- Interest and penalties may apply to outstanding underpayments.

At Irish Tax Rebates, we are trying to be pro-active and turn the underpayments into overpayments by claiming eligible tax credits you may be entitled to.

So, what happens next?

Once our team of tax experts at Irish Tax Rebates carry out a full review of your taxes there will be two possible outcomes.

1. Irish Tax Rebates carry out a full review and if our tax experts can reduce your underpayment. (see example 1 below)

Example 1

You originally had an underpayment of €750, but after Irish Tax Rebates claimed your eligible tax credits worth €350, your outstanding liability is now reduced to €400, which will be collected as follows through the tax you pay via your salary over the next four years:

2023: €100 (working out at less than €2 per week)

2024: €100 (working out at less than €2 per week)

2025: €100 (working out at less than €2 per week)

2026: €100 (working out at less than €2 per week)

2. Irish Tax Rebates carry out a full review and our tax experts calculate not only can we eliminate your underpayment but also, we can obtain a tax refund for you. These clients will be charged our standard fee on the refund element only. Remember, No Rebate, No Fee, No Catch! (See example 2 below)

Example 2

You originally had an underpayment of €500 in 2020. Irish Tax Rebates claimed your tax credits for medical expenses and flat rate expenses which then resulted in an overpayment of €1,000 from 2019.

€500 of this overpayment will be offset against the underpayment, and you will then receive a tax rebate of €500, less our fee of €43.05, resulting in you receiving €456.95 straight in to your bank account.

What is a Form 12?

A Form 12 is an essential document used in Ireland for filing income tax returns. It is primarily intended for individuals whose primary source of income is from PAYE (Pay As You Earn) employment or pensions. The form allows taxpayers to declare additional income beyond their regular employment, claim tax credits, allowances, and reliefs.

What we need our clients to do.

As previously mentioned, Irish Tax Rebates must receive permission from our clients to file their tax return in their outstanding years. To provide us with that permission, please click the button below and send us an email to details@irishtaxrebates.ie with your name, PPS number and a sentence to say you are providing us with your permission to carry out this task on your behalf.

Click below to provide permission for Irish Tax Rebates to review and file any underpayments.

| Permission |

For more information on our services, click here.