Did you know that you might be missing out on some extra cash in Ireland? It turns out that many people aren’t aware that they’re entitled to flat rate expenses in their profession.

But fear not; we’re here to help! Let us break down the flat rate expenses meaning and show you how to claim every cent you’re owed.

What are Flat Rate Expenses?

Flat rate expenses, sometimes called employment expenses, refer to the costs incurred by an employee on items and supplies deemed necessary to complete their work. These expenses are associated with specific professions and are designed to cover the cost of essential equipment required for employment, such as tools and uniforms.

Can Anyone Claim Flat Rate Expenses?

If you are a PAYE worker, you can claim flat rate expenses. There are over 200 professions eligible to claim tax back on flat rate expenses, including (but not limited to) Doctors, Nurses, Engineers, Tradespeople, Teachers, Lecturers, Hairdressers, and Beauticians.

Is Everyone Entitled to Flat Rate Expenses?

Not everyone is entitled to flat rate expenses. Employees who have incurred costs directly related to their employment are entitled to claim. You cannot claim flat rate expenses if you are self employed.

If you are self-employed, you can find out what tax relief you can claim on our sister website, Tax Returns Plus.

Do You Need Receipts to Claim Flat Rate Expenses?

No, you do not need your receipts for individual purchases to claim flat rate expenses. The flat-rate system has been designed by Revenue to simplify the process and reduce administrative burden for employees.

However, it’s essential to note that specific details and amounts vary based on the occupation and the nature of expenses claimed. Take a look at our flat rate expenses list to see what your profession is eligible to claim.

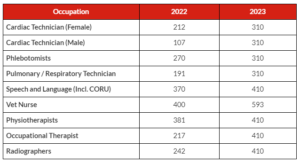

Increased Flat Rate Expenses List: 2022 vs 2023

How to Claim Flat Rate Expenses

Claim Your Flat Rate Expenses with Irish Tax Rebates!

With thousands of PAYE workers in Ireland who are eligible to claim flat rate expenses, why are we not claiming this money back? Many people simply do not realise they are eligible or don’t think it’s worth the paperwork.

As a registered Irish Tax Agent, we are happy to help maximise your tax rebate. Simply complete our 60 second application form, and we’ll get started on securing your largest rebate possible!

New Customers: Apply here.

Existing Customers: Apply For Additional Rebate