Guide to Claiming Tax Back for Employment Expenses

Let’s face it, no one wants to pay more tax than they have to; however, you might not even realise you’re doing it! Many of us PAYE workers in Ireland have professions that allow us to claim tax back for expenses in employment, but either don’t realise or don’t think it’s worth the paperwork.

What work expenses can I claim? What are allowable expenses? To ensure you’re not missing out on unclaimed tax on employee expenses, we’ve compiled a complete guide of everything you need to know.

What are Employment Expenses?

Or, what are the expenses of employment? Employment expenses, otherwise known as flat rate expenses, are costs incurred in the performance of the duties of your job that are directly related to the nature of the employee’s employment.

For example, tools for carpenters or electricians or uniforms for nurses or paramedics. Since these items are essential in order to conduct your duties of employment, you are eligible for tax relief on sums paid for such expenses or purchases. The expenses you claim tax back for must have been spent entirely on items essential to complete your work and nothing else.

What Expenses Can I Claim as a PAYE Employee?

As a PAYE employee, you can claim tax relief if you have had to buy and launder your own uniform. This can be particularly common with professions such as nurses, shop assistants, hotel and hospital staff, pilots, stewards, physiotherapists, pharmacists and opticians.

Another very common employment expense example eligible for tax relief is the purchase of tools and overalls by tradesmen e.g. carpenters, plumbers, mechanics, electricians etc.

Who Can Claim Employment Expenses?

There are over 200 professions recognised by the Revenue Commissioners as eligible for tax relief/deductions on employment expenses, including:

- Doctors

- Nurses

- Dentists

- Journalists

- Clergymen

- Hotel industry employees

- Firefighters

- Shop Assistants

- Teachers

Essentially, anyone from nurses to construction workers, to beauticians to hotel workers to shop assistants or even book-binders can claim tax back for certain employment expenses. The amounts vary depending on your profession and the different rates that are available, depending on what you provide for your work.

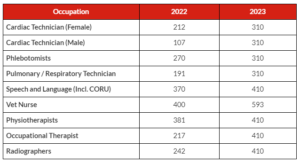

Increased Employee Expenses List: 2022 vs 2023

Fuel Allowance: What is it & Do I Qualify?

Effective from 1st September 2022, the public service updated its mileage and subsistence rates oo that the rates can also be used by private-sector employers to reimburse their employees’ travel expenses on a tax-free basis.

If you receive a mileage allowance for using your car for business purposes, it might not be taxed if it does not exceed the civil service mileage rates. Please note that expenses incurred for travelling to or from work are not eligible for tax relief.

If you are unsure if you can claim tax relief on mileage or fuel allowance, our tax experts will be able to help you, simply fill out our online form.

Claim Your Employment Expenses with Irish Tax Rebates!

If you are a PAYE worker and are still unsure about claiming tax relief on employment expenses you have incurred are, contact our team of tax experts at Irish Tax Rebates. We advise on tax relief applicable to your expenses and help you to get your money back in a matter of weeks.

We have the highest average tax rebate in Ireland and the lowest fee; and if you aren’t owed any tax back, there is no fee applied.

To get the ball rolling, you can fill out our 60-second application form:

New Customers: Apply here.

Existing Customers: Apply For Additional Rebate