How To Claim Tax Back on Dental Expenses Ireland

Dental work can be expensive, but many treatments qualify for tax relief, allowing you to deduct a proportion of their cost from your annual tax liability. If you’ve undergone dental treatment in the last four years, you can claim tax back on the procedure. This guide covers which treatments qualify for dental tax relief, the amount available for relief, and how to apply for tax back on dental expenses.

What Type of Dental Expenses Are Tax Deductible?

For a dental treatment to qualify for tax relief it must be classified as a specialised treatment. Any treatments that fall under the category of routine care do not qualify for dental tax refunds.

What is Routine Dental Care?

Routine Treatments that Do Not Qualify for Dental Tax Relief Include:

- Tooth extractions

- Scaling and cleaning

- Fillings

- Repair of artificial teeth and dentures

What is Non-routine Dental Care?

Non-Routine Treatments that Do Qualify for Dental Tax Relief Include:

- Crowns

- Veneers

- Bridges

- Gold posts and inlays

- Replacement tips

- Root canals, along with periodontal (gum)

- Orthodontic treatments (braces)

- Surgical extraction of impacted wisdom teeth in a hospital

How Much Tax Do You Get Back on Dental Expenses?

Dental tax relief for non-routine dental treatments is provided at the standard rate of 20% on the cost of eligible treatments. This means you can claim back 20% of the expenses incurred for these treatments.

You can claim tax relief for dental expenses incurred over the past four years. This allows you to receive a refund on treatments you have paid for within this time frame, ensuring you don’t miss out on potential savings.

Can I Claim Tax Back for Dental Work Abroad?

Dental tax relief can be claimed for dental work performed abroad, provided the dental practitioner is legally allowed to practice in the country where the treatment was carried out. This provision is beneficial if you seek specialised treatment abroad to take advantage of lower costs, or require urgent care while traveling.

Key points to consider when looking to claim dental tax relief abroad:

Qualified Practitioner:

The dental practitioner must be legally allowed to practice in the respective country and ensure that the treatment meets professional standards.

Eligible Treatments:

Tax relief applies to the same non-routine treatments eligible in Ireland.

Documentation:

Obtain a Form Med 2 from the dentist as a receipt for your dental expenses. This document should be retained for potential verification by Revenue.

Exclusions:

Travel expenses, including flights and accommodation, are not eligible for tax relief. Only the cost of the dental treatment is covered.

By understanding these considerations, you can effectively claim tax back on eligible dental treatments received abroad, making specialised, cost-effective dental care more accessible. This ensures that people who seek high-quality or necessary dental care outside Ireland can still benefit from the financial support provided by tax relief.

Applying for Dental Tax Relief

To claim tax relief on non-routine dental expenses, you need to follow these steps:

Get a Form Med 2:

Have your dentist complete a Form Med 2 after your treatment. This form is a receipt for dental expenses and is required to claim dental tax relief. Your dentist should provide you with this form, and if the treatment spans multiple years, a separate form should be completed each year.

File Your Claim with Irish Tax Rebates:

You can claim your dental expenses as part of your overall health expenses at the end of the tax year. Irish Tax Rebates make the process simple. Simply provide us with your unclaimed dental receipts in a Med 2 form for the past 4 years and we can claim your dental tax relief for you!

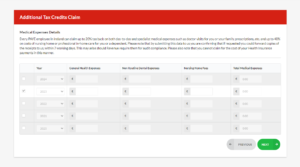

The process is simple, send us your receipts or update their expenses directly on our website with the claim additional rebates section.

Dental Tax Relief Frequently Asked Questions

How to Claim Dental Expenses?

To claim dental expenses, ensure you have a Form Med 2 from your dentist. Forward the Med 2 to Irish Tax Rebates. Retain a copy of the Med 2 form for your records, as Revenue may request it for verification.

Are Orthodontics Tax Deductible?

Yes, orthodontic treatments, such as braces, are considered non-routine treatments and are tax deductible. You can claim tax relief at the standard rate of 20%.

Can I Claim Back Dental Expenses on my Taxes?

Yes, you can claim dental expenses on your taxes for non-routine treatments. Obtain a Form Med 2 from your dentist, and include the expenses in your tax return.

Can I Claim Tax Back on Invisalign?

As Invisalign is a form of orthodontic treatment, it qualifies for tax relief as it is considered a non-routine dental expense, and you can claim back 20% of the cost of your treatment.

Claim Dental Tax Relief with Irish Tax Rebates!

Irish Tax Rebates has over 20 years of experience claiming back tax for many customers. We have the highest average tax rebate in Ireland and the lowest fee. Plus, if you aren’t owed any tax back, there is no fee to pay, making us an easy and risk-free solution. Check our excellent Trust Pilot reviews, apply online in an instant using our simple one-page online form and send us your Med2 Form from your dentist:

New Customers: Apply here.

Existing Customers: Apply For Additional Rebate

If you need any support with your dental tax refund, or if you have any other questions about your tax credits and allowances, feel free to call us on 059 8634 794 or email info@irishtaxrebates.ie anytime – our team of experienced tax professionals will be more than happy to help.